2022-2031 Global Dental Equipment Market Highlights

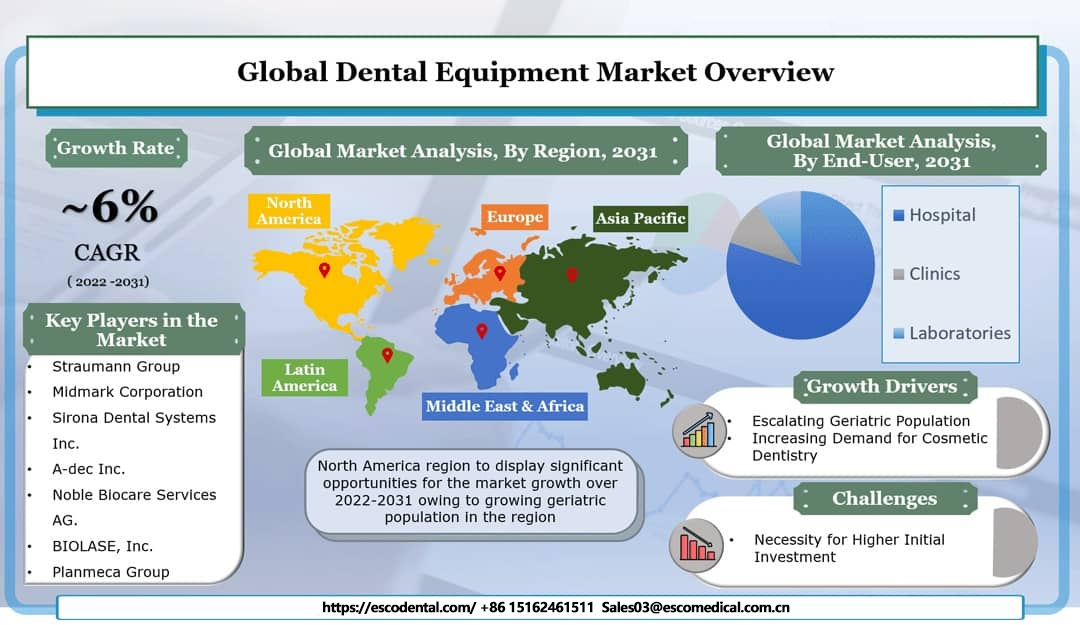

Analysts estimate that the global dental equipment market will grow at a compound annual growth rate (CAGR) of approximately 6% during the forecast period (2022 to 2031), resulting in significant revenue. Factors driving this market growth include the increasing elderly population and the rising demand for cosmetic dentistry, which involves improving the appearance of teeth and gums by altering their shape, size, alignment, position, and color.Additionally, people aged 65 and older are more likely to suffer from conditions like cavities, gum disease, and damaged root canals. According to data from the World Bank, the global elderly population was 723,484,054 in 2020. Furthermore, a report from the U.S. National Library of Medicine (NLM) stated that by the age of 74, 26% of people lose all their permanent teeth, while 69% of adults aged 35-44 lose at least one permanent tooth due to accidents. Dental equipment refers to the tools used by dentists for oral care, as well as for the detection and treatment of dental diseases. People are now more aware of dental problems than before and are seeking various ways to maintain dental health. We expect all these factors to positively impact the market during the forecast period.

Analysts segment the market by end users into hospitals, clinics, and laboratories.The hospital sector is expected to occupy a significant share of the global dental equipment market during the forecast period. This growth is due to its larger patient base and better facilities. Hospitals have dedicated dental departments and laboratories to conduct necessary tests.

Key Macroeconomic Indicators Affecting Market Growth

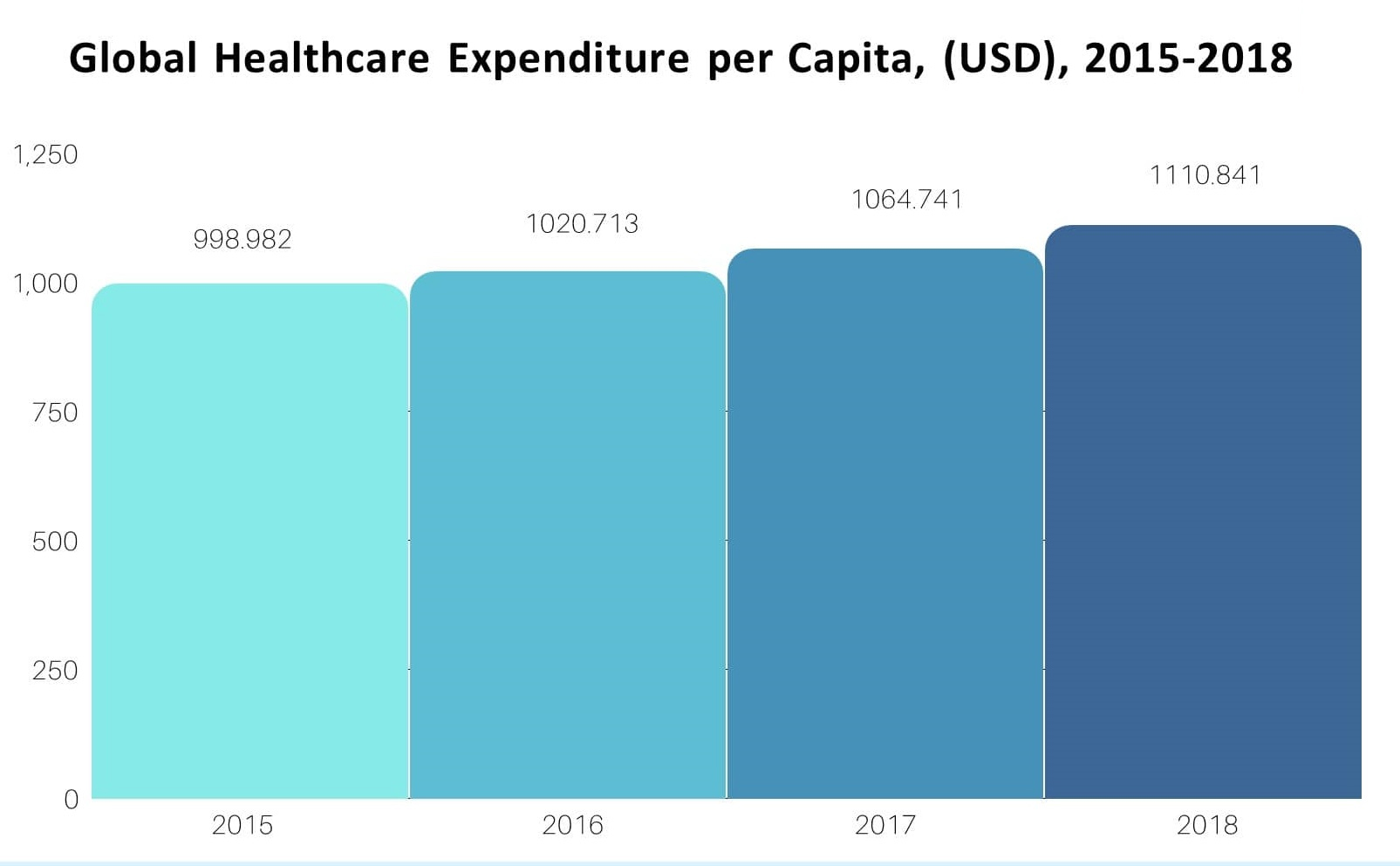

According to the World Health Organization, global per capita healthcare expenditure was USD 1,064.741 in 2017, up from USD 864.313 in 2008 to USD 1,110.841 in 2018. The United States ranked first in this regard, with per capita healthcare expenditure of USD 10,623.85 in 2018. As of 2018, U.S. domestic general government healthcare expenditure was USD 5,355.79, up from USD 3,515.82 in 2008. These factors have contributed to market growth in recent years. Additionally, according to the Centers for Medicare & Medicaid Services (CMS), the estimated annual percentage change in U.S. National Health Expenditure (NHE) in 2020 was 5.2%, compared to 4.5% in 2019. Analysts expect national health expenditure to reach USD 6,192.5 billion by 2028, with projections indicating that per capita expenditure will reach USD 17,611 that same year. Experts expect these notable indicators to create lucrative opportunities in the coming years.

Global Dental Equipment Market Regional Overview

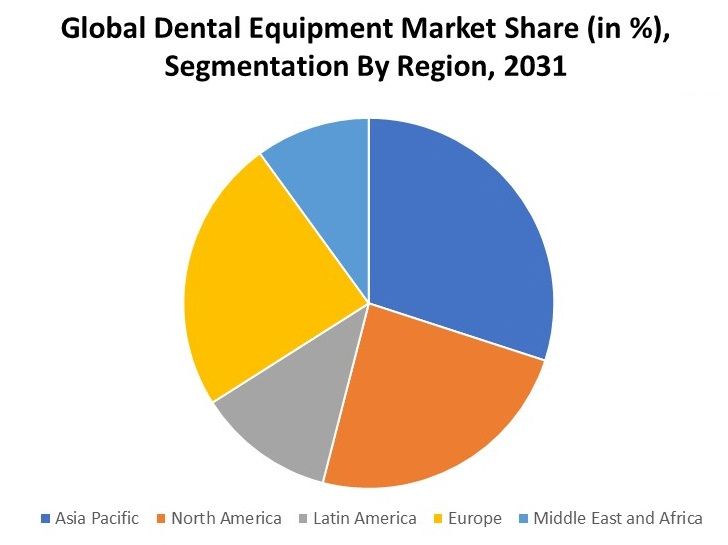

Analysts divide the global dental equipment market regionally into five major areas: North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa. Due to the increase in the elderly population and the rising prevalence of dental implants, experts expect the North American market to witness significant growth during the forecast period. One of the key drivers of growth in this region is the aging population. For instance, analysts estimated that the population aged 65 and older in North America was around 21 million as of 2019. Due to major lifestyle changes, experts expect the younger population in this region to require basic dental care during the forecast period.According to a report from the U.S. Centers for Disease Control and Prevention (CDC) in 2020, 63.0% of adults aged 18 visited a dentist, while the percentage of children aged 2-17 who did so in 2018 was estimated at 85.9%.

Due to increasing awareness of oral health and the growing availability of advanced medical facilities in developing regions, the Asia-Pacific market is expected to secure a considerable share of revenue during the forecast period. According to a report from the Indian Journal of Dental Research (IJDR), 0.1 to 300,000 dental implants are performed annually.

The global dental equipment market is further segmented by region as follows:

- North America (United States and Canada): Market size, year-over-year growth, market player analysis, and opportunity outlook.

- Latin America (Brazil, Mexico, Argentina, and other regions of Latin America): Market size, year-over-year growth, market player analysis, and opportunity outlook.

- Europe (United Kingdom, Germany, France, Italy, Spain, Hungary, Belgium, the Netherlands and Luxembourg, the Nordic countries (Finland, Sweden, Norway, Denmark), Ireland, Switzerland, Austria, Poland, Turkey, Russia, and other regions of Europe): Market size, year-over-year growth, market player analysis, and opportunity outlook.

- Asia-Pacific (China, India, Japan, South Korea, Singapore, Indonesia, Malaysia, Australia, New Zealand, and other regions of Asia-Pacific): Market size, year-over-year growth, market player analysis, and opportunity outlook.

- Middle East and Africa (Israel, Gulf Cooperation Council (Saudi Arabia, UAE, Bahrain, Kuwait, Qatar, Oman), North Africa, South Africa, and other regions of the Middle East and Africa): Market size, year-over-year growth, market player analysis, and opportunity outlook.

Market Segmentation

Our in-depth analysis of the global dental equipment market includes the following segments:

By equipment type:

Imaging equipment

- Cameras

- Sensors

- Panoramic view

- Lab parts

- Casting machines

- Lasers

- Dental radiology equipment

- Hygiene maintenance devices

- Others

By end user:

- Hospitals

- Clinics

- Laboratories

Growth Drivers:

- Increasing elderly population

- Growing demand for cosmetic dentistry

Challenges:

- High initial investment requirements